Printable 19 Form

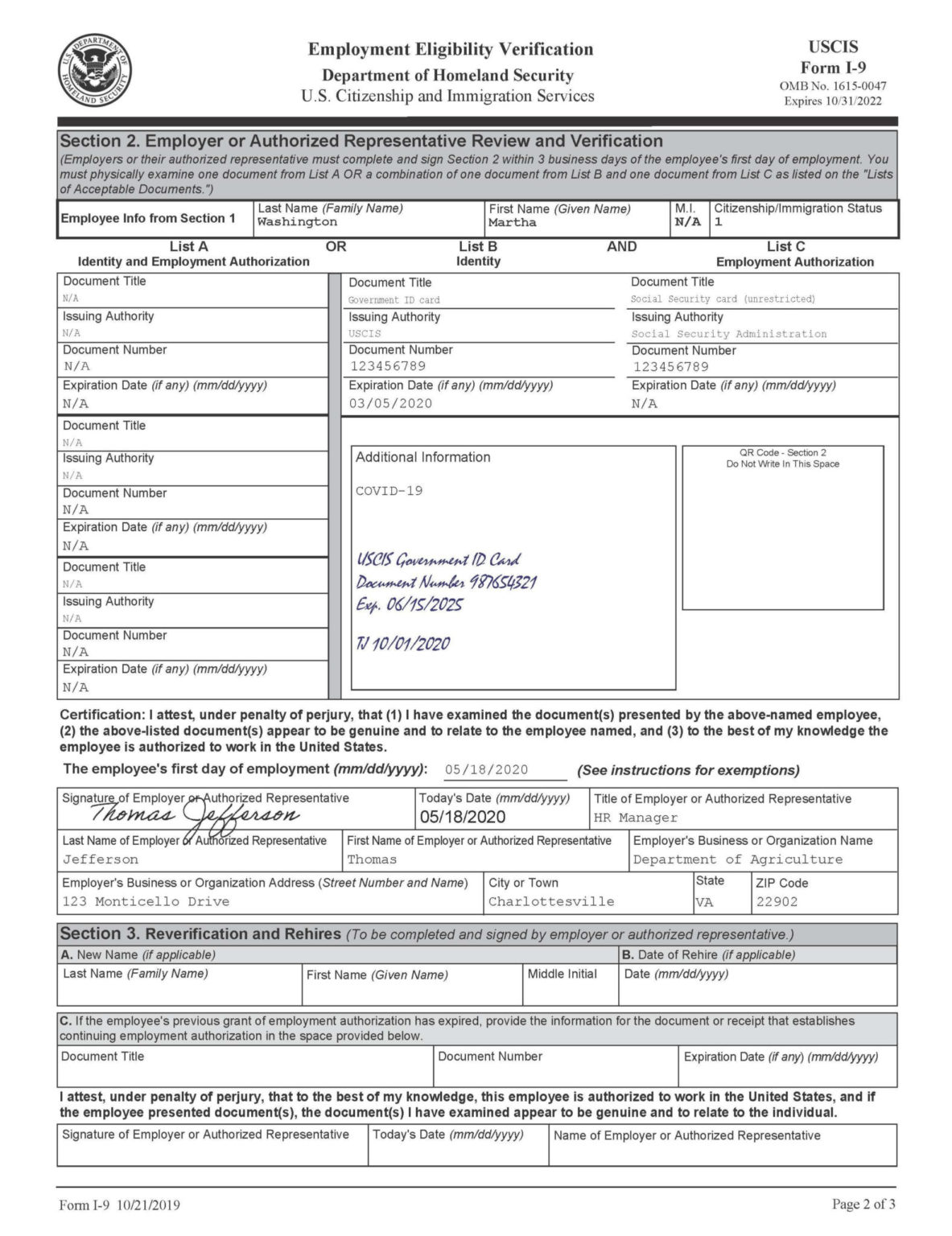

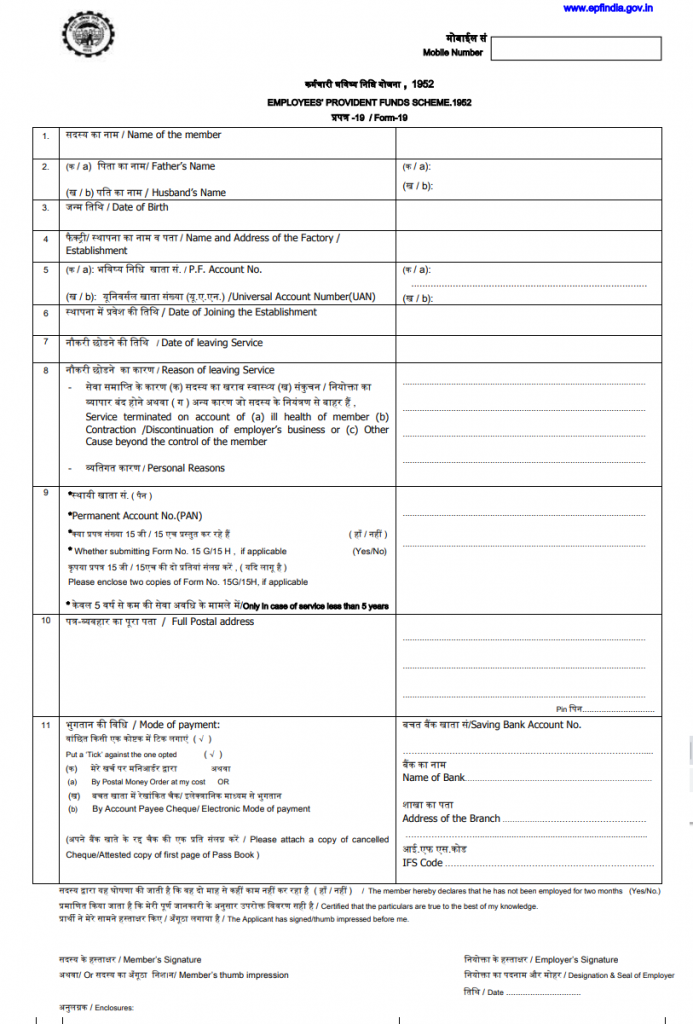

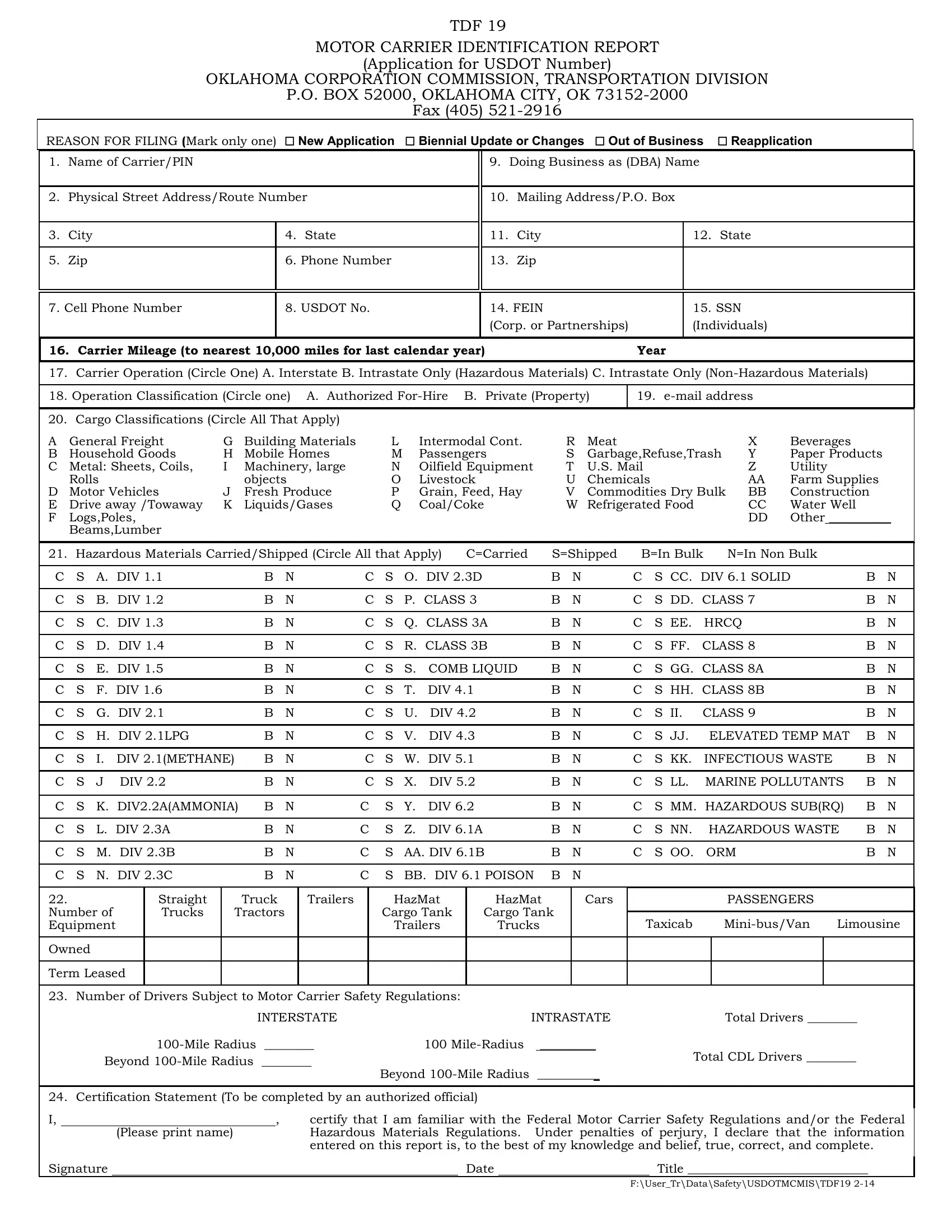

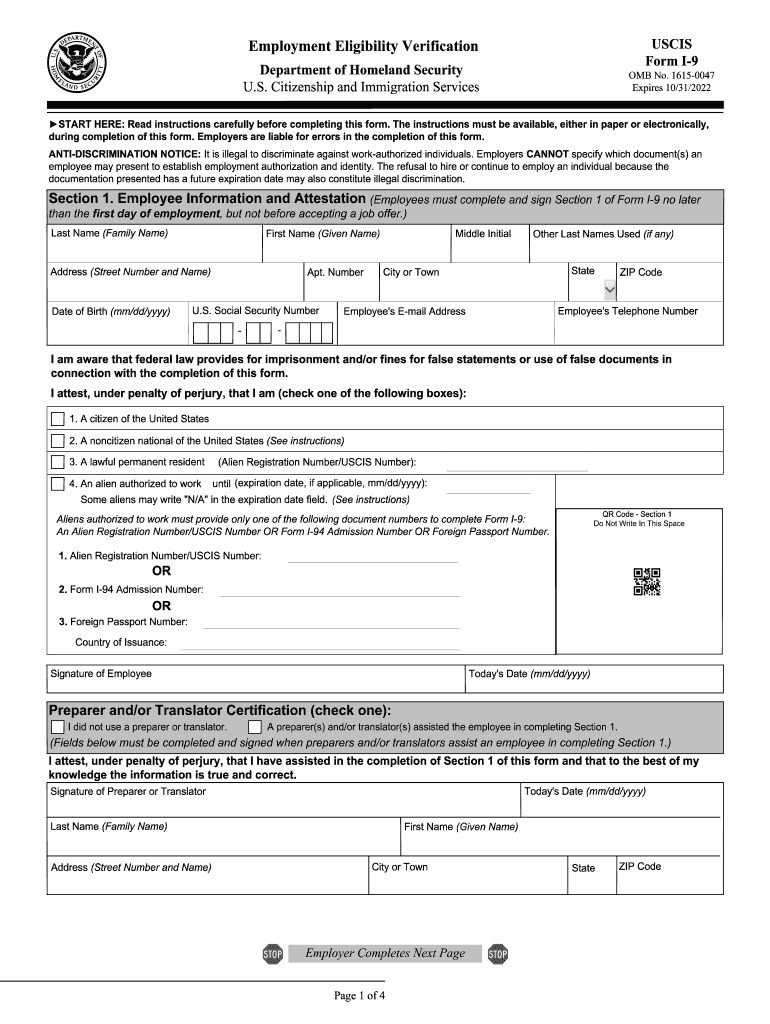

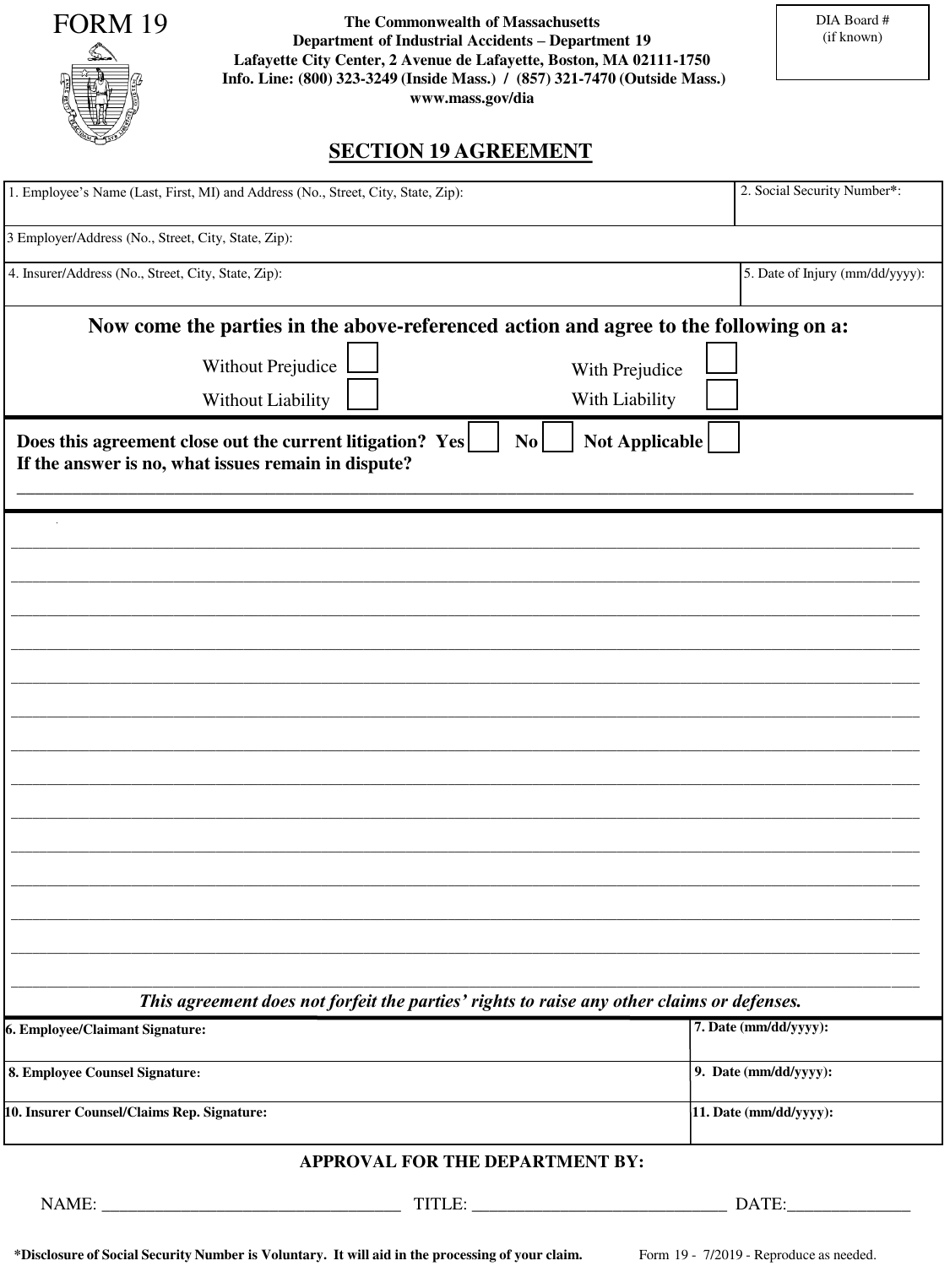

Printable 19 Form - Go to www.irs.gov/formw9 for instructions and the latest information. Give form to the requester. Only use this page if your employee requires reverification, is rehired within three years of the date the. This form is in portable document format (.pdf) that is fillable and. The instructions must be available during. Access irs forms, instructions and publications in electronic and print media. 2 part ii energy efficient home improvement credit section a—qualified energy efficiency improvements. Form 19 must be transmitted to the commission through your insurance carrier/claims administrator, and is required by law to be filed within 5 days after knowledge of accident. Do not send to the irs. The instructions must be available, either in paper or electronically, during completion of this form. 5695 (2024) form 5695 (2024) page. This form is in portable document format (.pdf) that is fillable and. Citizenship and immigration services, will help you verify your employee's identity and employment authorization. We’ll help you understand what it is, when you need to file it, and how to fill it out. (applicable in cases where employee's complete details in form i i (new), aadhaar number and bank accounts details are available on uan portal and uan has been activated) 2. The gaining agency should provide a copy of the completed form to the employee and forward the original to the payroll office. Read instructions carefully before completing this form. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created the following. The form is used to document verification of the identity and employment authorization of each new employee. The instructions must be available, either in paper or electronically, during completion of this form. Citizenship and immigration services, will help you verify your employee's identity and employment authorization. The form is used to document verification of the identity and employment authorization of each new employee. The instructions must be available during. The gaining agency should provide a copy of the completed form to the employee and forward the original to the payroll office. As. The gaining agency should provide a copy of the completed form to the employee and forward the original to the payroll office. A copy may also be filed in the employee’s official personnel folder. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created the following. The. We’ll help you understand what it is, when you need to file it, and how to fill it out. Only use this page if your employee requires reverification, is rehired within three years of the date the. Read instructions carefully before completing this form. 5695 (2024) form 5695 (2024) page. The instructions must be available, either in paper or electronically,. Give form to the requester. The form is used to document verification of the identity and employment authorization of each new employee. Go to www.irs.gov/formw9 for instructions and the latest information. Expires 08/31/12 read instructions carefully before completing this form. The instructions must be available during. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created the following. Citizenship and immigration services, will help you verify your employee's identity and employment authorization. The form is used to document verification of the identity and employment authorization of each new employee. Form 19 must be. This form is in portable document format (.pdf) that is fillable and. Read instructions carefully before completing this form. (applicable in cases where employee's complete details in form i i (new), aadhaar number and bank accounts details are available on uan portal and uan has been activated) 2. Only use this page if your employee requires reverification, is rehired within. 2 part ii energy efficient home improvement credit section a—qualified energy efficiency improvements. Go to www.irs.gov/formw9 for instructions and the latest information. Citizenship and immigration services, will help you verify your employee's identity and employment authorization. A copy may also be filed in the employee’s official personnel folder. The instructions must be available, either in paper or electronically, during completion. The instructions must be available during. Only use this page if your employee requires reverification, is rehired within three years of the date the. The form is used to document verification of the identity and employment authorization of each new employee. The gaining agency should provide a copy of the completed form to the employee and forward the original to. Do not send to the irs. 5695 (2024) form 5695 (2024) page. Citizenship and immigration services, will help you verify your employee's identity and employment authorization. Go to www.irs.gov/formw9 for instructions and the latest information. Access irs forms, instructions and publications in electronic and print media. 2 part ii energy efficient home improvement credit section a—qualified energy efficiency improvements. The form is used to document verification of the identity and employment authorization of each new employee. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created the following. Citizenship and immigration services, will. Access irs forms, instructions and publications in electronic and print media. Read instructions carefully before completing this form. Give form to the requester. We’ll help you understand what it is, when you need to file it, and how to fill it out. The instructions must be available during. Citizenship and immigration services, will help you verify your employee's identity and employment authorization. (applicable in cases where employee's complete details in form i i (new), aadhaar number and bank accounts details are available on uan portal and uan has been activated) 2. The form is used to document verification of the identity and employment authorization of each new employee. Expires 08/31/12 read instructions carefully before completing this form. 5695 (2024) form 5695 (2024) page. A copy may also be filed in the employee’s official personnel folder. Only use this page if your employee requires reverification, is rehired within three years of the date the. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created the following. Form 19 must be transmitted to the commission through your insurance carrier/claims administrator, and is required by law to be filed within 5 days after knowledge of accident. Do not send to the irs. The instructions must be available, either in paper or electronically, during completion of this form.Form I 9 Examples Related To Temporary Covid 19 Policies i9 Form 2021

Printable Form 19 Printable Forms Free Online

Ui19 Printable Form Printable Forms Free Online

Printable I 9 Form Print 2019

EPF Form 19 Steps to Fill Form 19 for PF Withdrawal in 2024

I9 Acceptable forms of Identification by UW Madison Housing Issuu

Fillable Online www.uscis.govi9centralcovid19formi9COVID19

Tdf 19 Form ≡ Fill Out Printable PDF Forms Online

2019 Form USCIS I9Fill Online, Printable, Fillable, Blank pdfFiller

19 Fillable Form Printable Forms Free Online

2 Part Ii Energy Efficient Home Improvement Credit Section A—Qualified Energy Efficiency Improvements.

The Gaining Agency Should Provide A Copy Of The Completed Form To The Employee And Forward The Original To The Payroll Office.

This Form Is In Portable Document Format (.Pdf) That Is Fillable And.

Go To Www.irs.gov/Formw9 For Instructions And The Latest Information.

Related Post: