Printable 1099 Form 2016

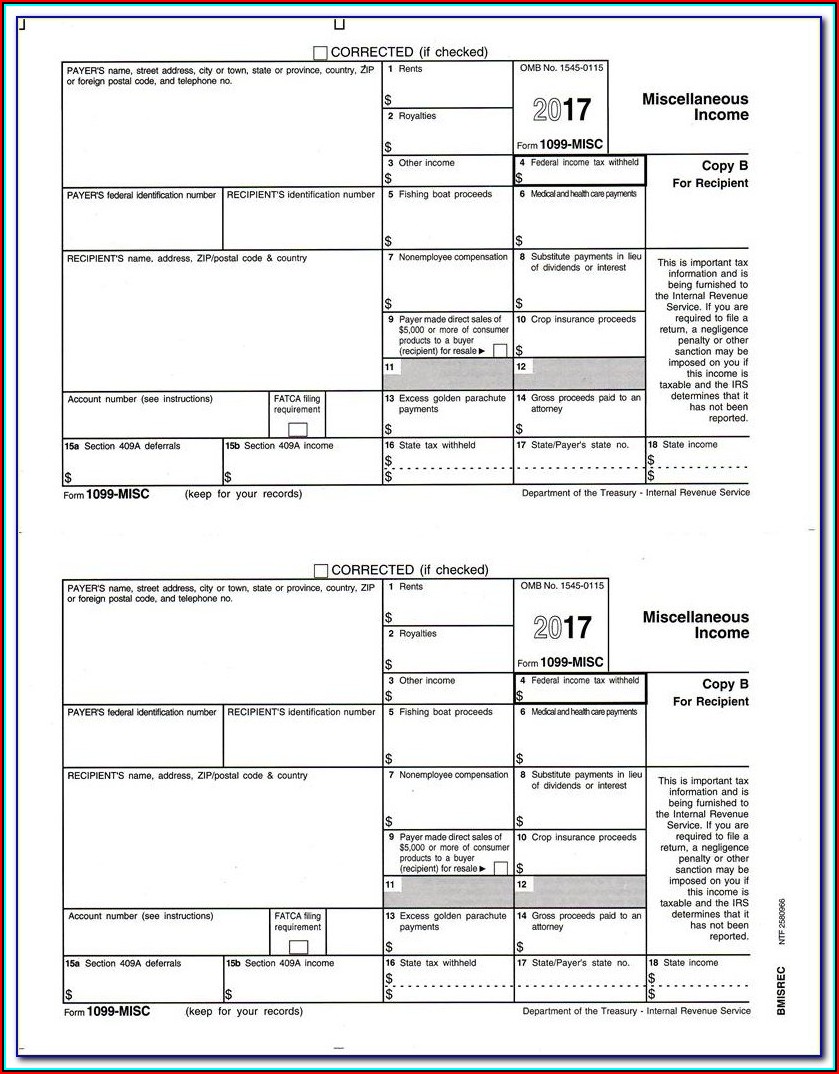

Printable 1099 Form 2016 - Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. In addition to these specific instructions, you should also use the 2016 general instructions for certain information returns. Go to www.irs.gov/freefile to see if you. You can actually find a handy list of instructions for 2016 1099 forms. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. If you are required to file a return, a. Please note that copy b and. The worksheets would be included in the pdf of the tax return in the. This is important tax information and is being furnished to the internal revenue service. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. If you are required to file a return, a. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification. The worksheets would be included in the pdf of the tax return in the. You can find the latest information for pretty much every 1099 form here on the irs site. 2016 general instructions for certain information returns. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. 31, 2015, which the recipient will file a tax return for in 2016. Please note that copy b and. You can actually find a handy list of instructions for 2016 1099 forms. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer did not show the taxable amount. The worksheets would be included in the pdf of the tax return in the. You can actually find a handy list of instructions for 2016 1099 forms. Business taxpayers can file electronically. 2016 general instructions for certain information returns. This is important tax information and is being furnished to the internal revenue service. You can actually find a handy list of instructions for 2016 1099 forms. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. 1099 misc is an irs tax. The worksheets would be included in the pdf of the tax return in the. 2016 general instructions for certain information returns. The free printable 1099 form for 2016 is specifically for reporting income earned in the year 2016. In addition to these specific instructions, you should also use the 2016 general instructions for certain information returns. If your annuity starting. The free printable 1099 form for 2016 is specifically for reporting income earned in the year 2016. Please note that copy b and. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. You can find the latest information for pretty much every 1099 form here on the irs site. The worksheets would be. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer did not show the taxable amount. The worksheets would be included in the pdf of the tax return in the. Among the notable changes this year is a tighter. Business taxpayers can file electronically any form 1099 series. The free printable 1099 form for 2016 is specifically for reporting income earned in the year 2016. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer did. 2016 general instructions for certain information returns. This is important tax information and is being furnished to the internal revenue service. The free printable 1099 form for 2016 is specifically for reporting income earned in the year 2016. You can actually find a handy list of instructions for 2016 1099 forms. Go to www.irs.gov/freefile to see if you. If you are required to file a return, a. 31, 2015, which the recipient will file a tax return for in 2016. This is important tax information and is being furnished to the internal revenue service. You can actually find a handy list of instructions for 2016 1099 forms. Please note that copy b and. If you are required to file a return, a. 2016 general instructions for certain information returns. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification. In addition to these specific instructions, you should also use the 2016 general instructions for certain information returns.. It is essential to accurately report all your income to the irs to avoid any penalties or fines. 2016 general instructions for certain information returns. 1099 misc is an irs tax form used in the united states to prepare and file information return to report various type of income and other than wages, salaries, and tips. Business taxpayers can file. This is important tax information and is being furnished to the internal revenue service. Go to www.irs.gov/freefile to see if you. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. In addition to these specific instructions, you should also use the 2016 general instructions for certain information returns. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification. 2016 general instructions for certain information returns. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Please note that copy b and. Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Those general instructions include information about the following. You can actually find a handy list of instructions for 2016 1099 forms. If you are required to file a return, a. It is essential to accurately report all your income to the irs to avoid any penalties or fines. 1099 misc is an irs tax form used in the united states to prepare and file information return to report various type of income and other than wages, salaries, and tips. You can find the latest information for pretty much every 1099 form here on the irs site.1099 Misc 2016 Free Template Template 2 Resume Examples 3q9JDJpVAr

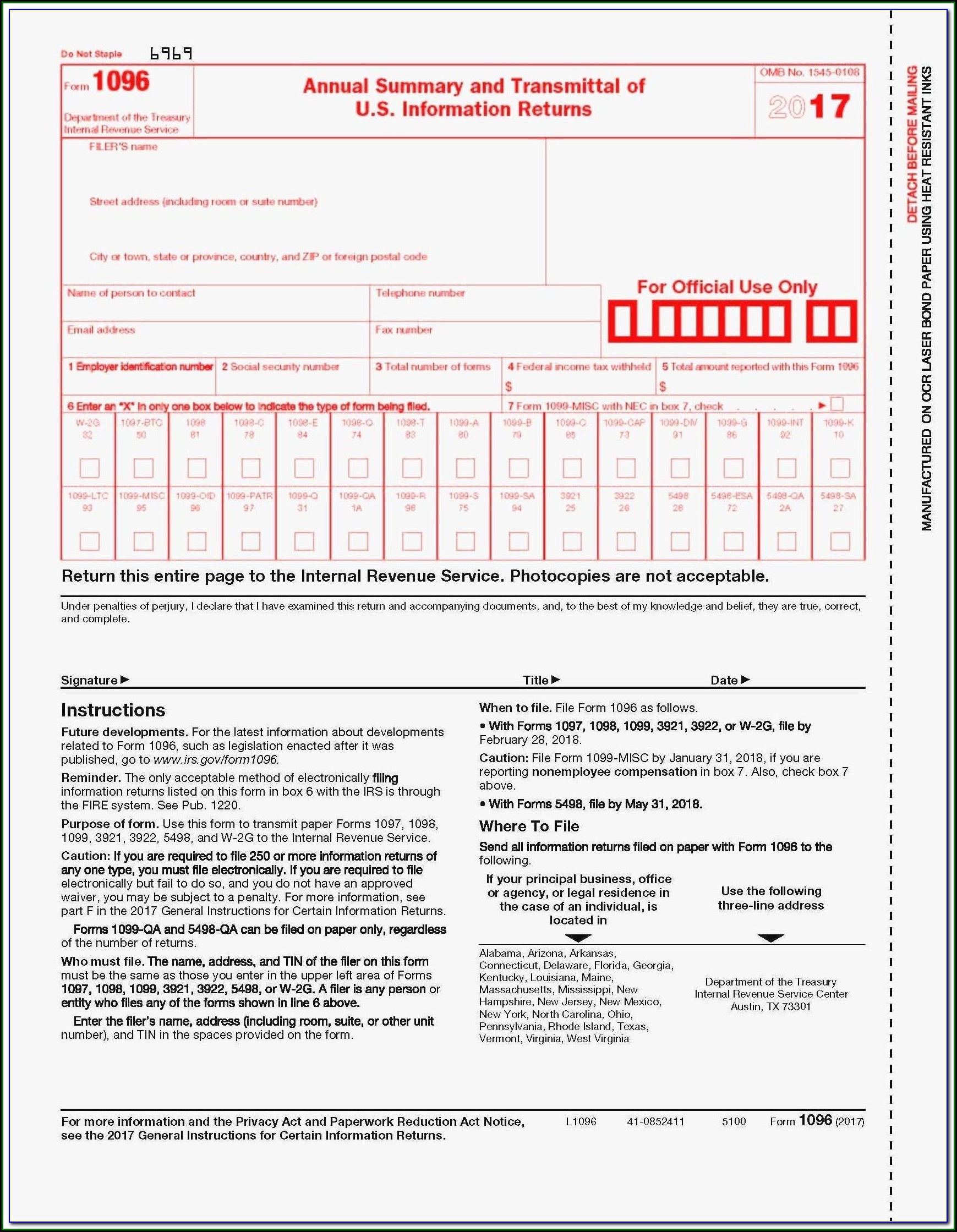

1099 Irs 2016 Related Keywords 1099 Irs 2016 Long Tail Keywords

Understanding Your Tax Forms 2016 Form 1099INT, Interest

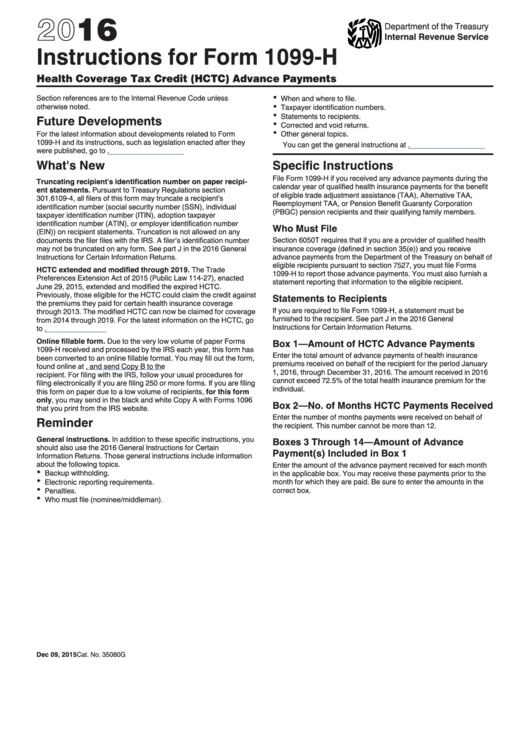

Instructions For Form 1099H 2016 printable pdf download

Printable 1099 Tax Form 2016 Form Resume Examples

1099 MISC TAX FORM 2016 Generator MISC Form 2016 Template Stubcheck

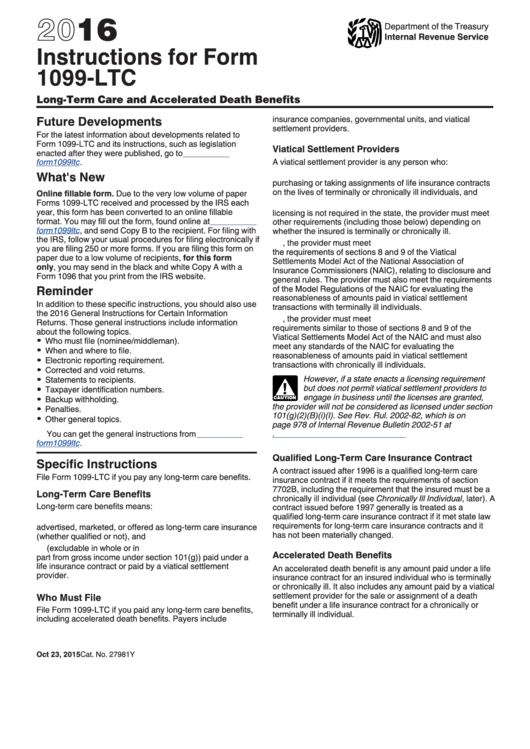

Instructions For Form 1099Ltc 2016 printable pdf download

2016 Form 1099 Misc Irs.gov Form Resume Examples GxKkVNLY17

Free 1099 Misc Form 2016 Form Resume Examples EZVgj6JYJk

Form 1099INT Interest (2016) Free Download

The Worksheets Would Be Included In The Pdf Of The Tax Return In The.

31, 2015, Which The Recipient Will File A Tax Return For In 2016.

Among The Notable Changes This Year Is A Tighter.

The Free Printable 1099 Form For 2016 Is Specifically For Reporting Income Earned In The Year 2016.

Related Post: