Credit Limit Worksheet A Printable

Credit Limit Worksheet A Printable - Learn how to calculate your earned income tax credit (eitc) and child tax credit using this essential. Residential clean energy credit (see instructions before completing this part.) note: Enter the aggregate amount of advance child tax credit payments you (and your spouse if filing jointly) received for 2021. Up to 8% cash back be sure you are using the correct worksheet. Edit your credit limit worksheet a online. Use this worksheet only if you answered no to step 5, question 2, in the instructions. Enter income from puerto rico that. See your letter(s) 6419 for the amounts to include on this line. Credit limit worksheet b before you begin: Mortgage interest credit, form 8396. Credit limit worksheet b before you begin: You can also download it, export it or print it out. Enter the aggregate amount of advance child tax credit payments you (and your spouse if filing jointly) received for 2021. Mortgage interest credit, form 8396. Up to 40% cash back send credit limit worksheet a 2023 via email, link, or fax. Up to 8% cash back 2022 schedule 8812 credit limit worksheet a keep for your records 1. Enter the complete address of. Learn how to calculate your credit limit for the earned income tax credit (eitc), child tax credit, and. Section references are to the internal revenue. The ctc and odc are nonrefundable credits. Complete the earned income worksheet, later in these instructions. Enter income from puerto rico that. Mortgage interest credit, form 8396. The calculation is based on the credit limit worksheet a in the schedule 8812 instructions. The ctc and odc are nonrefundable credits. Complete the earned income worksheet, later in these instructions. Enter the aggregate amount of advance child tax credit payments you (and your spouse if filing jointly) received for 2021. Edit your credit limit worksheet a online. Section references are to the internal revenue. Credit limit worksheet b before you begin: Line 13 on schedule 8812 is a calculated number in the turbotax program. Complete the earned income worksheet, later in these instructions. I believe you are referring to the credit limit worksheet in the instructions to form 8812. Enter the amount from form. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education. The credit limit worksheet a is a. Learn how to calculate your earned income tax credit (eitc) and child tax credit using this essential. Skip lines 1 through 11 if you only have a. Up to 8% cash back be sure you are using the correct worksheet. Discover how the credit limit worksheet a aids in determining credit eligibility and. Enter the amount from form. Edit your credit limit worksheet a online. Credit limit worksheet b before you begin: Maximize your tax savings with the irs credit limit worksheet. Skip lines 1 through 11 if you only have a. Learn how to calculate your earned income tax credit (eitc) and child tax credit using this essential. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Use this worksheet only if you answered no to step 5, question 2, in the instructions. Edit your credit. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. That worksheet won't appear in turbotax, even though the program uses the. The credit limit worksheet a is a. Section references are to the internal revenue. Maximize your tax savings with the irs credit limit worksheet. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Enter the amount from form. The credit limit worksheet a is a. You can also download it, export it or print it out. The ctc and odc are nonrefundable credits. Enter the aggregate amount of advance child tax credit payments you (and your spouse if filing jointly) received for 2021. Maximize your tax savings with the irs credit limit worksheet. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Learn how to calculate your. Use this worksheet only if you answered no to step 5, question 2, in the instructions. Section references are to the internal revenue. I believe you are referring to the credit limit worksheet in the instructions to form 8812. Part i child tax credit and credit for other dependents. Discover how the credit limit worksheet a aids in determining credit. Complete the earned income worksheet, later in these instructions. Residential clean energy credit (see instructions before completing this part.) note: Enter the amount from form. Use this worksheet only if you answered no to step 5, question 2, in the instructions. Section references are to the internal revenue. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Edit your credit limit worksheet a online. I believe you are referring to the credit limit worksheet in the instructions to form 8812. Enter the aggregate amount of advance child tax credit payments you (and your spouse if filing jointly) received for 2021. The calculation is based on the credit limit worksheet a in the schedule 8812 instructions. Maximize your tax savings with the irs credit limit worksheet a. You can also download it, export it or print it out. See your letter(s) 6419 for the amounts to include on this line. Learn how to calculate your earned income tax credit (eitc) and child tax credit using this essential. Discover how the credit limit worksheet a aids in determining credit eligibility and impacts your final credit amount with essential calculations. Enter income from puerto rico that.2022 Instructions for Schedule 8812 (2022) Internal Revenue Service

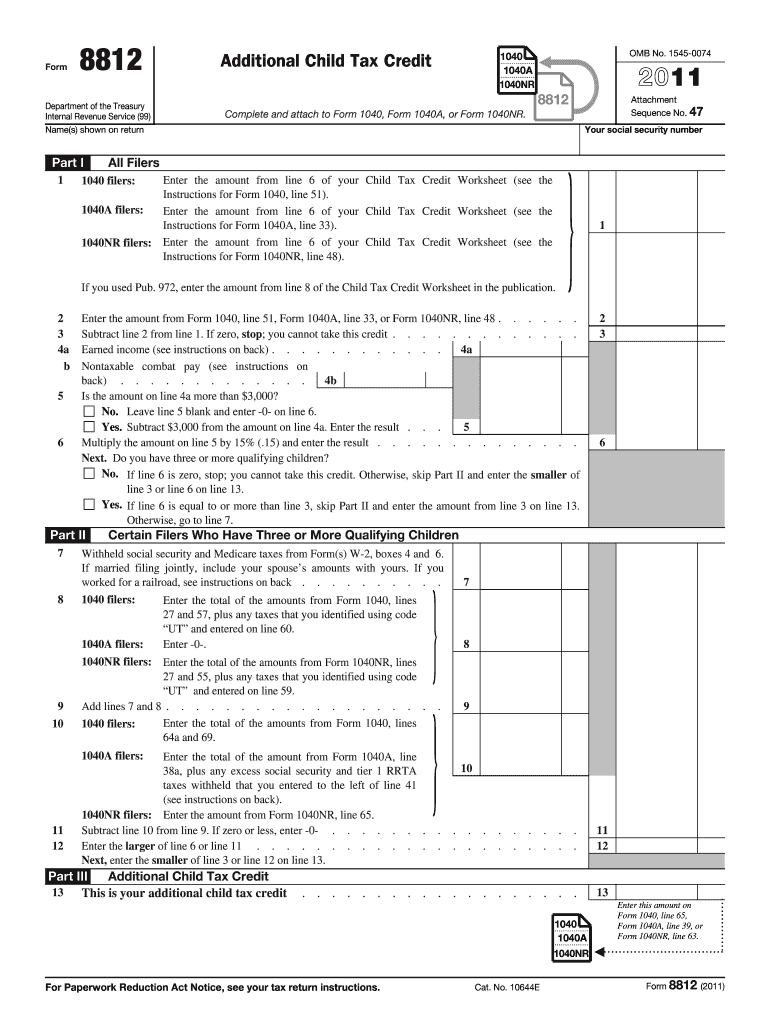

Schedule 8812 Credit Limit Worksheet A

Instructions Schedule 8812 Herb and Carols Child

2023 Schedule 8812 Credit Limit Worksheet A

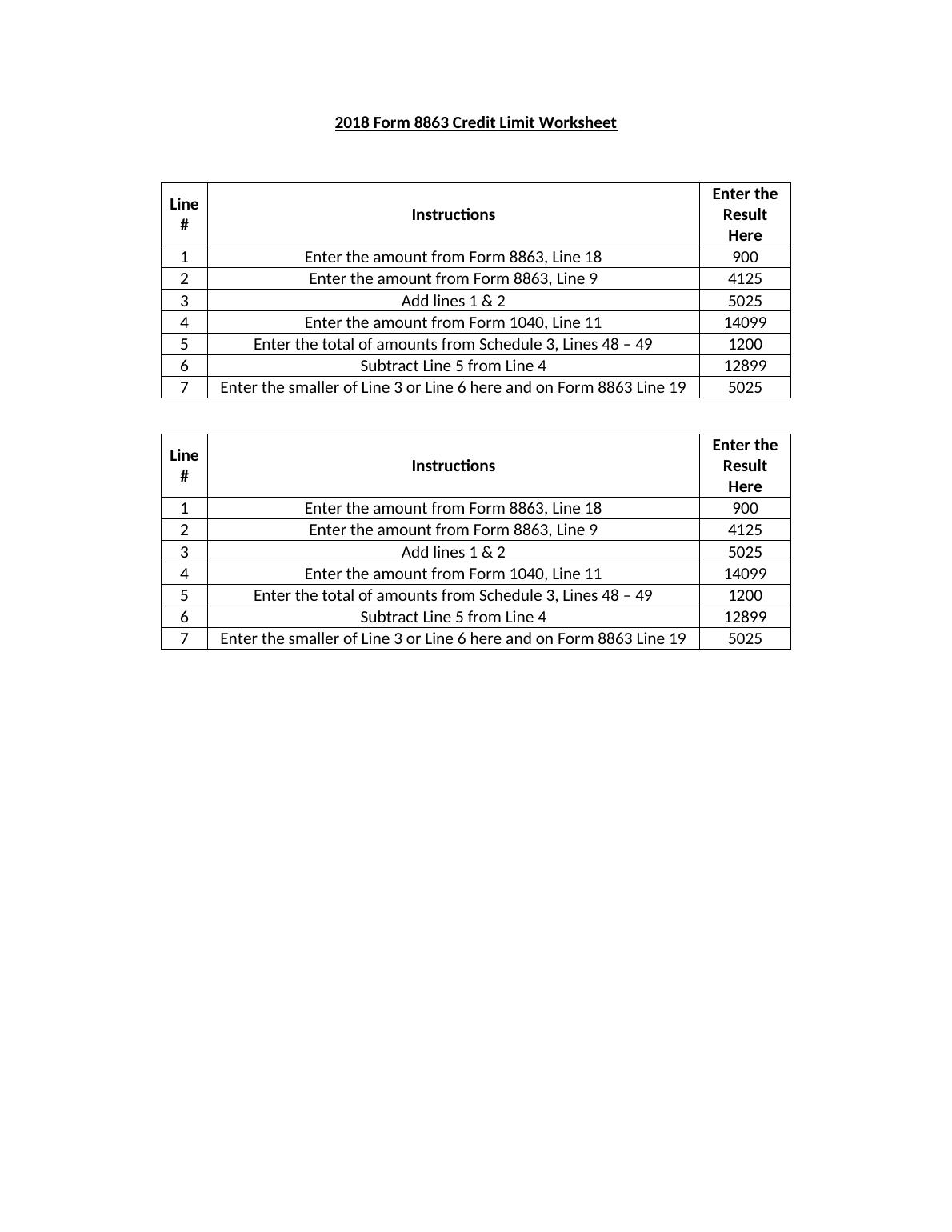

2018 Form 8863 Credit Limit Worksheet.

Form 8863 Credit Limit Worksheet Printable Word Searches

Credit Limit Worksheet A Form

Blank 8863 Credit Limit Worksheet Fill Out and Print PDFs

Form 8812 Credit Limit Worksheet A 2022

2023 Schedule 8812 Credit Limit Worksheet A

Use Form 8863 To Figure And Claim Your Education Credits, Which Are Based On Adjusted Qualified Education Expenses Paid To An Eligible Educational Institution (Postsecondary).

Skip Lines 1 Through 11 If You Only Have A.

The Ctc And Odc Are Nonrefundable Credits.

Up To 8% Cash Back 2022 Schedule 8812 Credit Limit Worksheet A Keep For Your Records 1.

Related Post: