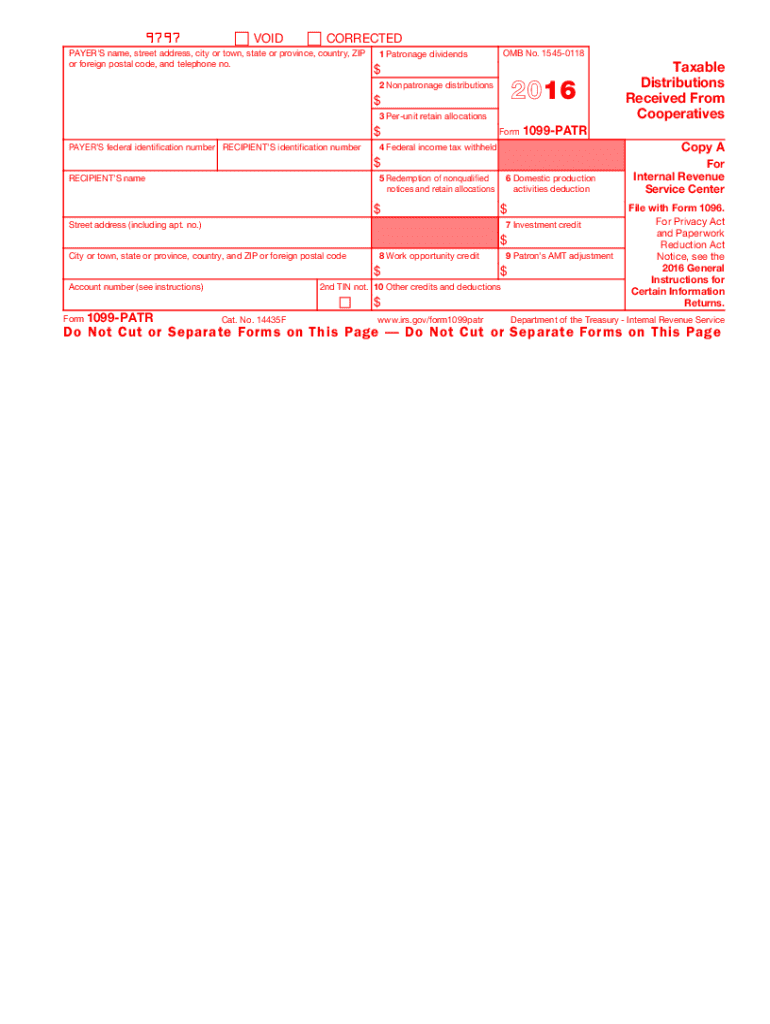

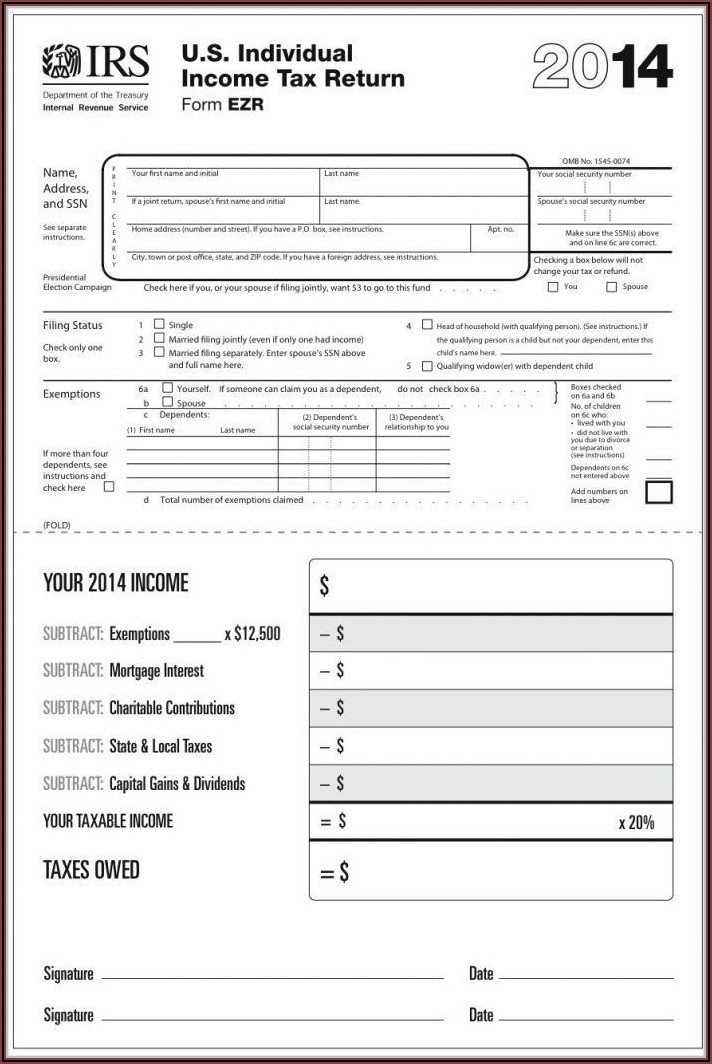

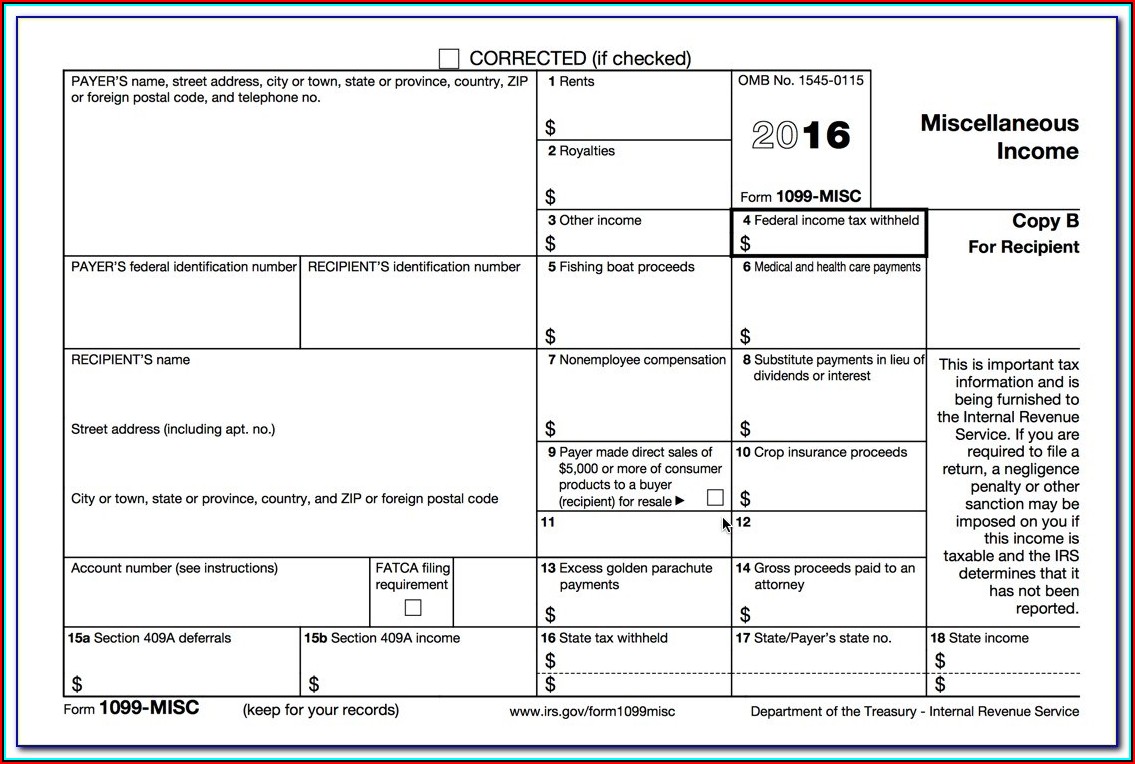

2016 Printable 1099 Tax Form

2016 Printable 1099 Tax Form - The following forms are available: Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. If you are required to file a. In accordance with urpo ruling #5, effective 1/1/2016 tax collectors and taxpayers must file their tax returns electronically. This is important tax information and is being furnished to the internal revenue service. 31, 2015, which the recipient will file a tax return for in 2016. Select your state(s) and download, complete, print,. This is important tax information and is being furnished to the internal revenue service. Official irs pdfs vs scannable forms. At least $10 in royalties (see the instructions for box 2) or At least $10 in royalties (see the instructions for box 2) or Mail the forms to the address listed on the irs and state forms. Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Copy b report this income on your federal tax return. 31, 2015, which the recipient will file a tax return for in 2016. Illinois department of revenue returns, schedules, and registration and related forms and instructions. This is important tax information and is being furnished to the internal revenue service. To file an amended return for a previous year, please. Among the notable changes this year is a tighter. In accordance with urpo ruling #5, effective 1/1/2016 tax collectors and taxpayers must file their tax returns electronically. The following forms are available: Download, complete, print, and sign the 2016 irs tax forms. Official irs pdfs vs scannable forms. Illinois department of revenue returns, schedules, and registration and related forms and instructions. Among the notable changes this year is a tighter. Copies of a form 1099 would have to obtained from the issuer of the form. Among the notable changes this year is a tighter. This is important tax information and is being furnished to the internal revenue service. At least $10 in royalties (see the instructions for box 2) or See part o in the current general. Copy b report this income on your federal tax return. To access your current or prior year online tax returns sign onto the turbotax website with the. To file an amended return for a previous year, please. At least $10 in royalties (see the instructions for box 2) or The following forms are available: 2016 general instructions for certain information returns. Mail the forms to the address listed on the irs and state forms. These documents are in adobe acrobat portable document format (pdf). To access your current or prior year online tax returns sign onto the turbotax website with the. 31, 2015, which the recipient will file a tax return for in 2016. Copy b report this income on your federal tax return. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. In accordance with urpo ruling #5, effective 1/1/2016 tax collectors and taxpayers must file their tax returns electronically. 2016 general instructions for certain information returns. Select your state(s) and download, complete, print,. You can find the latest information for pretty much every 1099 form here on the irs site. To access your current or prior year online tax returns sign onto the turbotax website with the. Illinois department of revenue returns, schedules, and registration and related forms and instructions. The following forms are available: This page allows state of illinois vendors to. At least $10 in royalties (see the instructions for box 2) or Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. This page allows state of. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. This is important tax information and is being furnished to the internal revenue service. Illinois department of revenue returns, schedules, and registration and related forms and instructions. Official irs pdfs vs scannable forms. To access your current or prior. If you are required to file a. Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Mail the forms to the address listed on the irs and state forms. Copy b report this income on your federal tax return. Illinois department of revenue returns, schedules, and registration. Official irs pdfs vs scannable forms. If you are required to file a. Copies of a form 1099 would have to obtained from the issuer of the form. 31, 2015, which the recipient will file a tax return for in 2016. Download a copy of your 1099 or 1042s tax form so you can report your social security income on. Print and file copy a downloaded from this website; Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. If you are required to file a. 31, 2015, which the recipient will file a tax return for in 2016. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Copy b report this income on your federal tax return. 2016 general instructions for certain information returns. Download, complete, print, and sign the 2016 irs tax forms. To file an amended return for a previous year, please. At least $10 in royalties (see the instructions for box 2) or In accordance with urpo ruling #5, effective 1/1/2016 tax collectors and taxpayers must file their tax returns electronically. These documents are in adobe acrobat portable document format (pdf). Illinois department of revenue returns, schedules, and registration and related forms and instructions. The following forms are available: This is important tax information and is being furnished to the internal revenue service. Official irs pdfs vs scannable forms.Printable 1099 Tax Form 2016 Form Resume Examples

Pdf 2016 1099 Fill out & sign online DocHub

Understanding Your Tax Forms 2016 Form 1099INT, Interest

What is a 1099 Form, 1099 Form, 1099 Form Know How

Printable Tax Form 1099 R MBM Legal

2016 Form 1099 Misc Irs.gov Form Resume Examples GxKkVNLY17

Form 1099INT Interest (2016) Free Download

1099 Tax Form Printable Excel Printable Forms Free Online

1099 Printable Tax Forms Form Resume Examples 4x2ve5PV5l

Printable 1099 Form 2016 Form Resume Examples gA19Xoe24k

Copies Of A Form 1099 Would Have To Obtained From The Issuer Of The Form.

This Is Important Tax Information And Is Being Furnished To The Internal Revenue Service.

Business Taxpayers Can File Electronically Any Form 1099 Series Information Returns For Free With The Irs Information Returns Intake System.the Iris.

2016 General Instructions For Certain Information Returns.

Related Post: