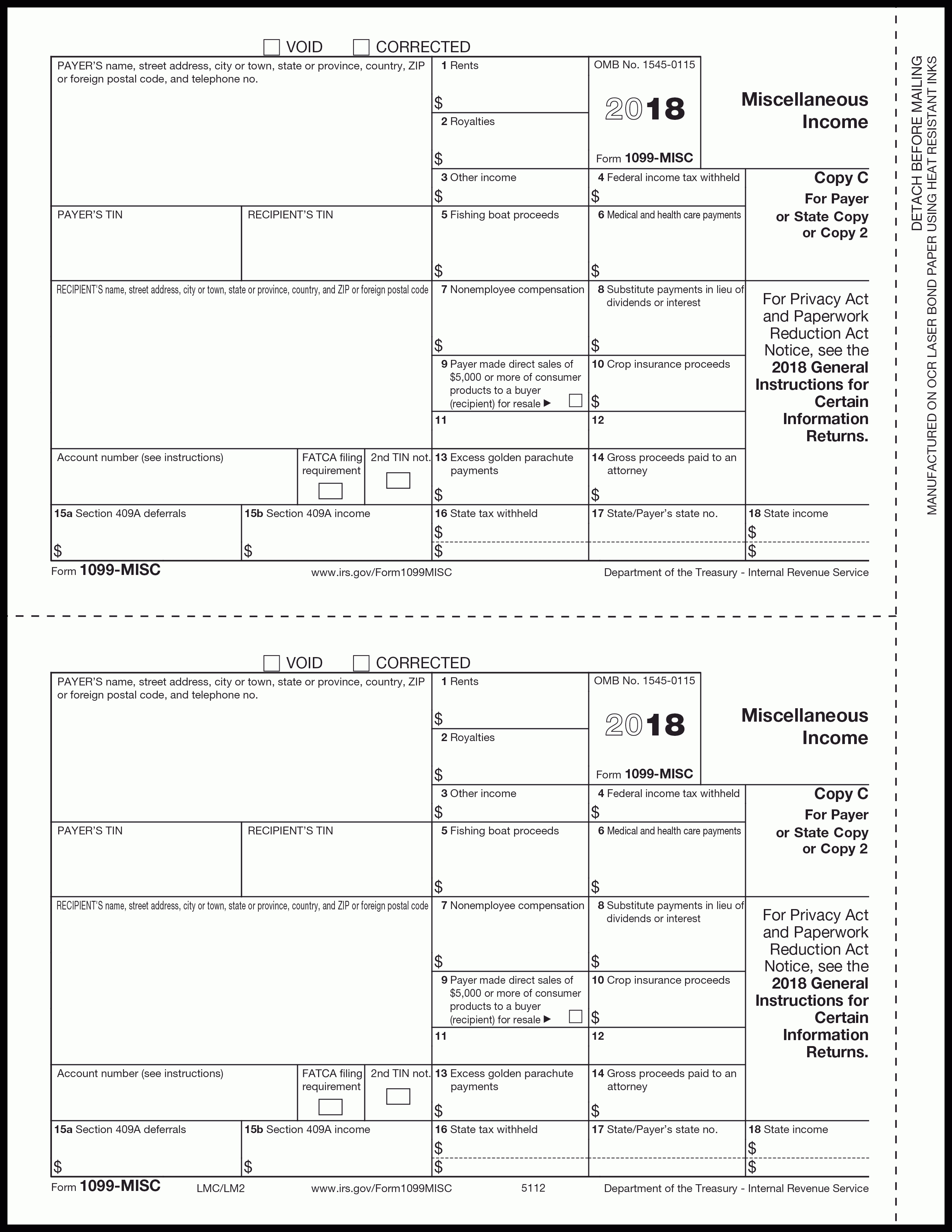

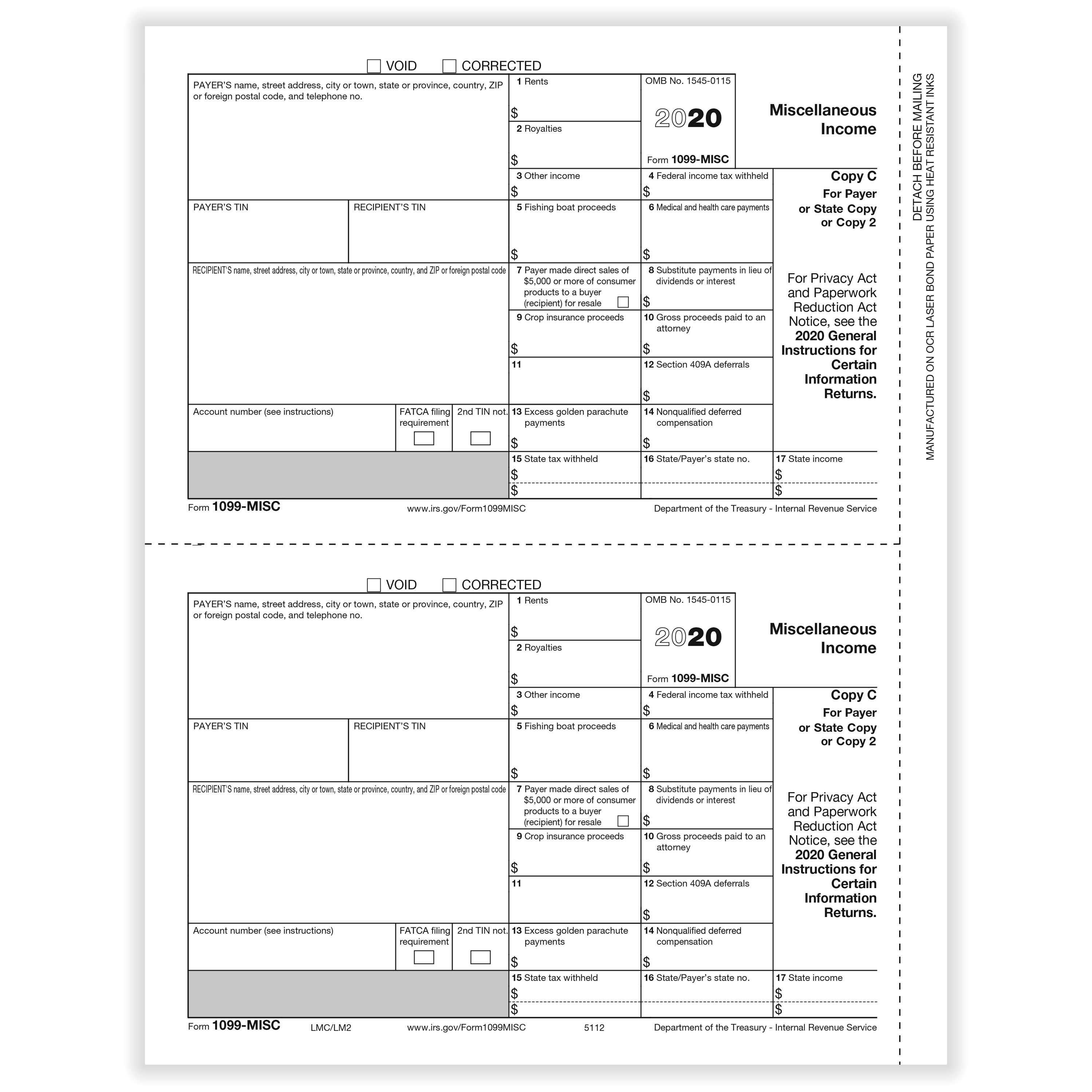

1099 Misc Printable Form

1099 Misc Printable Form - Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Simply hit download, fill in your details, and send it in to the irs. Fill in, efile, print, or download forms in pdf format. This includes paying $10 or more in royalties or broker payments instead of dividends. Go to www.irs.gov/freefile to see if you qualify for no. Beholden to their own tax reporting requirements and file their own tax returns. If you paid someone under certain conditions during the year, file a 1099 misc form. There are nearly two dozen different kinds of 1099 forms, and each. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. The 1099 misc form is generally used to record specific income, like. This includes paying $10 or more in royalties or broker payments instead of dividends. How much do i need to earn to use a. If you paid someone under certain conditions during the year, file a 1099 misc form. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. There are nearly two dozen different kinds of 1099 forms, and each. Simply hit download, fill in your details, and send it in to the irs. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Download the pdf form and instructions, or order online from the. Fill in, efile, print, or download forms in pdf format. The 1099 misc form is generally used to record specific income, like. Go to www.irs.gov/freefile to see if you qualify for no. This includes paying $10 or more in royalties or broker payments instead of dividends. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Our guide describes the basics of the nearly two dozen different 1099 forms used to. Fill in, efile, print, or download forms in pdf format. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. This includes paying $10 or more in royalties or broker payments instead of dividends. If you paid someone under certain conditions during the year, file a 1099 misc form.. Go to www.irs.gov/freefile to see if you qualify for no. Fill in, efile, print, or download forms in pdf format. There are nearly two dozen different kinds of 1099 forms, and each. This form reports various types of income and withholding to the irs and the recipient. Beholden to their own tax reporting requirements and file their own tax returns. The 1099 misc form is generally used to record specific income, like. Simply hit download, fill in your details, and send it in to the irs. If you paid someone under certain conditions during the year, file a 1099 misc form. Beholden to their own tax reporting requirements and file their own tax returns. This form reports various types of. The 1099 misc form is generally used to record specific income, like. Fill in, efile, print, or download forms in pdf format. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Go to www.irs.gov/freefile to see if you qualify for no. This includes paying $10 or more in royalties. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. There are nearly two dozen different kinds of 1099 forms, and each. Beholden to their own tax reporting requirements and file their own tax returns. This form reports various types of income and withholding to the irs and the recipient.. The 1099 misc form is generally used to record specific income, like. This form reports various types of income and withholding to the irs and the recipient. If you paid someone under certain conditions during the year, file a 1099 misc form. This includes paying $10 or more in royalties or broker payments instead of dividends. How much do i. Fill in, efile, print, or download forms in pdf format. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Beholden to their own tax reporting requirements and file their own tax returns. How much do i need to earn to use a. If you paid someone under certain. How much do i need to earn to use a. Simply hit download, fill in your details, and send it in to the irs. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. This includes paying $10 or more in royalties or broker payments instead of dividends. This. Beholden to their own tax reporting requirements and file their own tax returns. Simply hit download, fill in your details, and send it in to the irs. How much do i need to earn to use a. This includes paying $10 or more in royalties or broker payments instead of dividends. There are nearly two dozen different kinds of 1099. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. There are nearly two dozen different kinds of 1099 forms, and each. Go to www.irs.gov/freefile to see if you qualify for no. The 1099 misc form is generally used to record specific income, like. This form reports various types of income and withholding to the irs and the recipient. Fill in, efile, print, or download forms in pdf format. This includes paying $10 or more in royalties or broker payments instead of dividends. Download the pdf form and instructions, or order online from the. Simply hit download, fill in your details, and send it in to the irs.2025 2025 Misc Form Fillable Mariam Grace

Free Printable 1099 Misc Form 2013 Free Printable

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

Printable Fillable 1099 Nec

Printable Form 1099 Misc

1099 Misc Form Printable prntbl.concejomunicipaldechinu.gov.co

Print Blank 1099 Form Printable Form, Templates and Letter

1099 Employee Form Printable

1099MISC 3Part Continuous 1" Wide Formstax

Irs Printable 1099 Misc Form Printable Forms Free Online

Beholden To Their Own Tax Reporting Requirements And File Their Own Tax Returns.

If You Paid Someone Under Certain Conditions During The Year, File A 1099 Misc Form.

How Much Do I Need To Earn To Use A.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)